- #Why can't quicken for mac connect with suntrust bank update#

- #Why can't quicken for mac connect with suntrust bank manual#

This hurts their chances to build credit and wealth, and it also makes it more likely that they will make use of alternative financial providers like payday lenders. Several studies have found that branch closures disrupt those relationships, reducing small business lending in a community by as much as 20 % for years following the closure of a single branch even when there is a network of other local banks nearby.Īs branches close, especially in places that lack a large number of other banks, more and more families become unbanked. Small business lending is largely a relational process: the branch manager or small business specialist build personal connections with local businesses and through those relationships glean ‘soft information’ about the businesses, which includes details on the risks of lending to them. When banks close a local branch, that community’s small business lending is often severely impacted as well. “Research generally finds that higher concentration in banking markets may lead to less favorable conditions for consumers, especially in markets for small business loans, retail deposits and payment services.” The inconvenience experienced when a local branch closes has wider repercussions in the concentration of markets and the loss of competition which reduces people’s ability to have a choice of banks. The damage of diminished financial services access doesn’t end there. Figure 1: Decrease in all full-service bank branch locations nationally, 2008-2016 (Source: FDIC data and author’s calculations) In fact, the closures can result in the creation of banking deserts, especially in rural areas of America’s heartland, negatively impacting consumers in several ways. Instead of providing larger networks with expanded financial services access, banks often identify the cost savings of closing branch locations as a benefit for their shareholders. However, several studies note that these benefits come with drawbacks. When banks merge, Community Reinvestment Act (CRA) provisions require that they show how the merger will positively impact the communities that they are chartered to serve.īanks often tout the benefits of merging in terms of service, citing larger networks of branches and ATMs as a benefit to the consumer. Because it will be so big, the merger has the attention of critics who say it is too big, including some members of Congress, where the House Financial Services Committee scheduled a hearing on the deal today. When this merger is complete, it will be the sixth largest bank in the country. and the National Community Reinvestment Coalition (NCRC) announced their $60 billion community benefits plan for the region served by Truist Financial Corporation, the combined company to be created through the proposed merger of the two banks. I'm always here to help.Last week, BB&T Corporation, SunTrust Banks, Inc. Please let me know by adding a comment below. If you have any other follow-up questions about the online banking connection. Once your bank transactions are downloaded into QBO, here's how you can categorize and match them to your existing entries. You can open this article for more hints about fixing online banking connections. Go to the Banking menu, select the blue tile for your bank.

#Why can't quicken for mac connect with suntrust bank update#

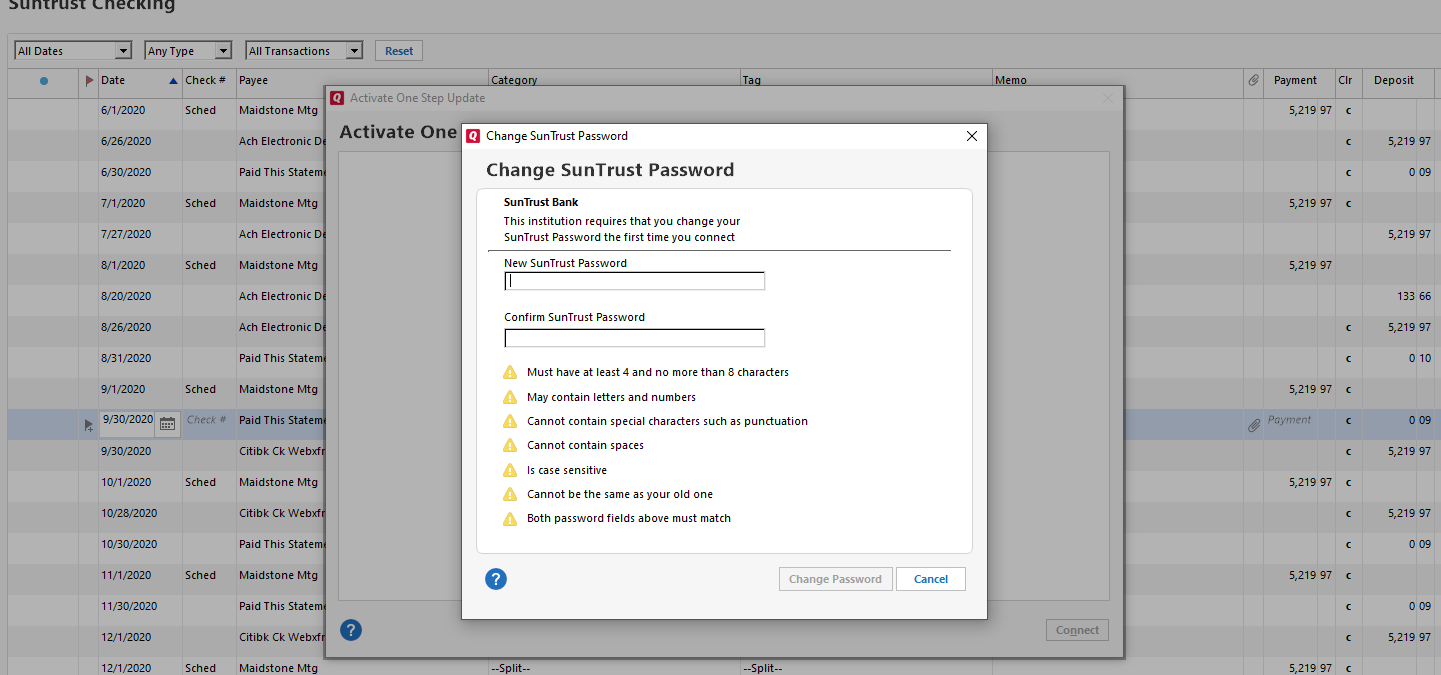

If there are changes to your bank's website, update your bank information in QBO as well to match the account's details.

#Why can't quicken for mac connect with suntrust bank manual#

Then, go back to your QuickBooks Online (QBO) account to perform a manual update. Check your bank’s website for any announcements.Review your account page for messages, notifications, or alerts.Once signed in, perform the following steps: You can contact the bank to request they establish a relationship with Intuit.įirst, I recommend logging in to your bank's website to review any alerts that need your attention. The bank may not be a participating bank.

You might want to check and select the correct one or try all possible links.

I want to you'll get your account connected seamlessly. Hi, are no reported cases about not being able to connect SunTrust Business Online Banking to QuickBooks.

0 kommentar(er)

0 kommentar(er)